WEBINAR

Navigating Financial Wellness in Turbulent Times

Monday, May 19 at 12 PM ET

Join us for expert insights and strategies to tackle financial wellness challenges in uncertain times.

Kelli Send

Senior VP and Certified

Financial Planner,

Francis, LLC

Rachel LaBerge

Right On the Money

Program Director,

HES

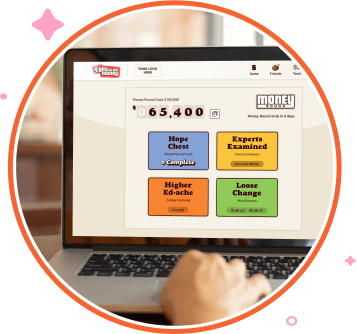

Game On: Right On the Money Participants Learn by Playing

Money mastery can be intimidating for many. Right On the Money removes the fear and reduces financial stress by making learning about personal finances fun, then providing simple steps to get on the path to financial well-being.

Educational and Entertaining

In its 2 parts (each lasts 2 weeks) — Money Round and Double Your Money Round — players earn virtual dollars by completing categories they choose. They become immersed in the game, going at their own pace while gaining financial wellness tools, knowledge and confidence.

Something for Everyone

With 18 topics, players select the categories and financial goals most important to them, creating a personalized game experience to match their interests, priorities, and life stage. The result is a customized financial wellness program that meets employees where they are and empowers them to achieve financial stability and confidence.

Driving Engagement

Augmenting game elements — and creating buzz — are tried and true social tools, including a Friends feature, optional team competition, and interactive wall. Plus daily financial well-being tips give players the option to share favorites.

Everyone Wins!

Whether laying the foundation of a secure future, fine-tuning money decisions as retirement approaches, or somewhere in between, Right On the Money puts participants on the right path to financial health.

Right On the Money forced me to stop, think about my financial situation, and start to improve. I think the information is easy enough for anyone to understand, regardless of financial literacy, and has a lot to offer.

Jared E.

State of Illinois CMS Benefits

Right On the Money was RIGHT ON!!! WOW, learned so much even though I thought I knew a lot. Truly enjoy it.

Participant

Prince Georges County

Government

It is cool to see the difference between registration and evaluation and that participants gained financial confidence in just 4 weeks!

Deanna D.

Wellness Manager

Case Western Reserve University

Do financial wellness programs make a difference?

Yes! Analysis of 76 peer-reviewed studies — representing a sample size of 160,000+ from all walks of life — concludes financial well-being programs work, delivering “sizable effects on both financial knowledge and financial behaviors.”

Money Specialists

Francis LLC‘s CFPs (Certified Financial Planners) have reviewed our Right On the Money content.

Learn More

Right On the Budget

(It just makes cents.)

Per Registrant

Includes site setup +

per registrant fee.

Duration

Retail

4-week Program

$19.28

Setup (1 time fee/challenge)

$2775

Group License

One-time fee covering your entire eligible population* for any 1 HES challenge.

*Eligible population means all employees who have access to the site (whether or not they register). To promote the site to a subset of your population, an eligibility file is required.

Eligible Population

Retail

1000

$5007

5000

$12,702

10,000

$23,156

25,000

$48,733

50,000

$85,764

100,000

$122,796

Bundled License

One-time fee covering your entire eligible population* for any 2 HES challenges within 12 months.

*Eligible population means all employees who have access to the site (whether or not they register). To promote the site to a subset of your population, an eligibility file is required.

1 discounted fee for 2 challenges and unlimited participation

1 agreement, 1 invoice

(no more hassle for another approval)

1 dedicated account manager to keep it all running smoothly.

Have Questions?

WHITE PAPER

Financial well-being — like other dimensions such as physical, mental, and community health — is important to each of us. After all, most Americans identify money as a major source of stress. Organizations can ease stress and enhance productivity by offering tools that empower employees to make informed and confident financial decisions.

WHITE PAPER

Financial well-being — like other dimensions such as physical, mental, and community health — is important to each of us. After all, most Americans identify money as a major source of stress. Organizations can ease stress and enhance productivity by offering tools that empower employees to make informed and confident financial decisions.